The late 1990s saw a rise in the popularity and diffusion of the Internet into businesses. This gave rise to a new generation of small companies – Startups – which relied on the Internet as a primary medium to conduct business (such as e-commerce), while existing businesses (back then) were still focused on their brick and mortar operations. These startups were primarily operated by entrepreneurs, each having a unique product of service to offer. Unlike conventional businesses, startups could be set up and operated much more easily, hence were gaining popularity. The Internet was growing at a phenomenal rate, which allowed startups greater rate of expansion than traditional businesses.

However, this growth created a bubble in the market (subsequently labelled ‘The Dotcom Bubble’), which was inflated by money easily available and little oversight (possibly due to lack of knowledge as this was a new field of business). The bubble burst in a few years into the new millennium, which shut down several startups. Nonetheless, there were some companies which survived and are now some of the world’s largest brands, such as Amazon and EBay.

Not all was doom and gloom after The Dotcom Bubble bust, though, as there was a better understanding of how to get things right; learning from the mistakes made and also from other companies which survived, such as Amazon. Consequently, we are now experiencing a similar surge in the Startup ecosystem, akin to the pre-‘Bubble’ era. Many startups are now thriving, primarily due to these factors:

The Internet’s increasing maturity

This is the foundation on which Startups survive. The Internet transcends geographic borders, allowing businesses and consumers to connect easily. Businesses do not have to set up a physical location everywhere in order to cater to clients. This benefits businesses in many ways, such as reduction in operational cost (this money can then be utilized in other departments); increased customer outreach and most platforms do businesses 24 hours/day (hence greater revenue); the Internet makes scaling the business easier (increased efficiency and faster growth). Furthermore, the Internet allows people mobility, meaning work can be done anywhere and not just in the office. This allows businesses to get professionals to work for (such as freelancers) fairly quickly (again, increasing efficiency).

Even consumers have greatly benefitted from startups. They provide consumers the convenience of getting what they want wherever they are. Some startups have also leveraged the Internet as a platform to create new products and services, which were previously unavailable. (eg. Social Media platforms and Cloud Computing solutions, which are primarily offered by startups (some of which are now global enterprises) could only be done through the Internet).

It should not come as a surprise that consumers are now preferring making purchases over the internet. With an increasing popularity amongst consumers, the market potential for startups to capture is immense. As expected, existing startups are now growing at quickly, and new ones are entering the market. A study of startups in the USA in 2016 found 1% of the companies were up-scaled (reach a level of at least 50 employees) from 2015, while the number of new startups starting operations was close to 60% – 10% increase from 2015.

Entrepreneurs – powered by Accelerators and Incubators, backed by Angels

Another reason why startups are mushrooming worldwide is due to the increase in entrepreneurial spirit within people and the support they receive. Gen Y and Gen Z individuals are now leading the new generation of the workforce. It is widely known that these generations tend to be more entrepreneurial, and while a significant number go on to join conventional businesses, an increasing number of them prefer the startup environment – despite lower pay, longer working hours, job uncertainty.

Outside startups, there are more support options available to them, than big businesses previously had. In addition to the obvious consulting companies, startups can get support from entities such as accelerators and incubators. Essentially, an accelerator provides support by helping startups refine their product, provide (some) funding and other resources (such as employees and work spaces), and provide assistance in networking with potential mentors and certain market segments. However, their support is for a short period of time (usually lasting 3-4 months maximum).

Similarly, incubators provide support to entrepreneur who are still building the company. The startup may only possess an idea but no business model or direction to move from the idea phase to reality. Since they are helping businesses just starting out, there is no fixed duration of support and do provide same level of networking and marketing assistance as accelerators. However, incubators do not provide any funding; the startups then are usually funded by external investors, such as traditional financial institutes or startup-oriented venture capitals and angel investors. Venture capitals (VC) and angel investors are entities who provide funding to startups for a share of their company; the only difference is VCs are companies and angels are individuals. There are also some entrepreneurs like Anton Klingspor, who not only provide funding (angels) but also the support of incubators.

Global venture capitals invested close to $40 Billion in Q2 of 2017 alone, while in the US alone, the number of accelerator programs is increasing greatly (170 in 2017 compared to only 18 in 2008).

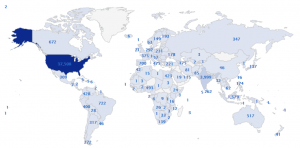

Figure: Number of startups worldwide – by country (2017)

Figure: Number of startups worldwide – by country (2017)

While it is difficult to pin an exact number, the figure above attempts to show the massive scale of the existing startup industry worldwide. Startups are leaner and easier to manage than traditional businesses, hence attract an increasing number of people. Entrepreneurs are coming up with disruptive ideas to cater to the people mostly through the internet, and are getting support from accelerators, incubators and investors. Global venture capitals invested close to $40 Billion in Q2 of 2017 alone, while in the US alone, the number of accelerator programs is increasing greatly (170 in 2017 compared to only 18 in 2008). It is unsurprising that we are seeing a rise in the number of startups worldwide, though it would be a fool’s errand to try accurately find out the number of startups in the world or combined value.

If you would like to contribute an article or contact our contributors, you can get in touch here